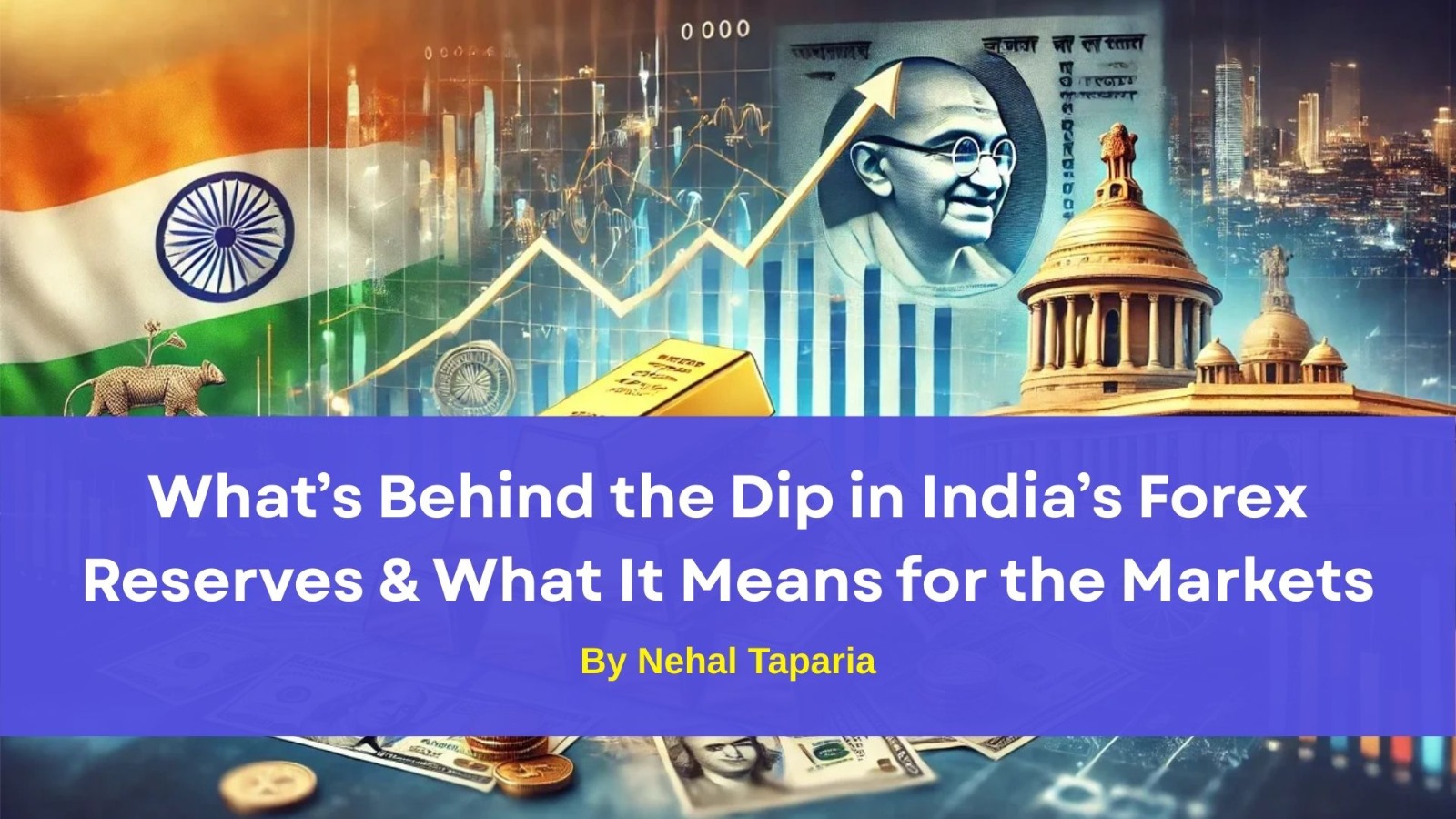

What’s Behind the Dip in India’s Forex Reserves & What It Means for the Markets

What’s Behind the Dip in India’s Forex Reserves & What It Means for the Markets

Introduction

India’s foreign exchange (forex) reserves fell by USD 396 million, bringing the total to USD 702.57 billion as of September 19, 2025 — according to the Reserve Bank of India (RBI). While the decline is modest relative to the total size, it raises questions about trends, macro risks, and market implications.

In this post, we’ll unpack:

- What caused the dip

- What the composition of reserves looks like

- Risks and benefits of having high reserves

- How this might influence the Indian financial markets

- What to watch going forward

What caused the dip?

A few key drivers:

- Decline in Foreign Currency Assets (FCAs): FCAs — the biggest component of forex reserves — fell by USD 864 million to USD 586.15 billion during that week.

- Gold, SDR, IMF positions: Offsetting somewhat, gold reserves rose by USD 360 million to USD 92.78 billion. Special Drawing Rights (SDRs) increased by USD 105 million and India’s reserve position with the IMF rose by USD 2 million.

- Rupee / currency movements: In dollar‐terms, the valuation of reserves depends on exchange rate movements (not just actual inflows or outflows). Fluctuations in non‐USD currencies (euro, pound, yen) held in the reserves also feed into the figures.

- RBI interventions / liquidity operations: The RBI sometimes intervenes (by selling or buying dollars) to manage rupee volatility or maintain “orderly conditions” in the forex market. These interventions can cause week‐to‐week movements in reserves.

So, this dip appears more of a short‐term ebb rather than a structural collapse.

Reserve Composition Snapshot

As of September 19:

|

Component |

Level (approx) |

Change |

|

Foreign currency assets (FCAs) |

USD 586.15 billion |

– USD 864 million |

|

Gold reserves |

USD 92.78 billion |

+ USD 360 million |

|

SDRs |

USD 18.88 billion |

+ USD 105 million |

|

Reserve position with IMF |

USD 4.76 billion |

+ USD 2 million |

Thus, while FCAs bore the brunt of the drawdown, precious metals and SDRs provided some cushion.

Why are high forex reserves important?

Maintaining high forex reserves is generally considered beneficial for a country’s macro stability. Some of the key reasons:

- Buffer against external shocks: In times of balance of payments stress (e.g. capital flight, trade shocks), reserves act as a buffer.

- Support currency stability: The central bank can intervene in the FX markets when the domestic currency is under pressure (sell dollars, buy rupees, or vice versa).

- Improves sovereign credibility: Strong reserves can signal to global markets that a country is better positioned to service external liabilities, which may help in sovereign rating and investor confidence.

- Facilitates external debt payments: Especially important if a country has dollar‐denominated debt or obligations.

However, holding large reserves also has costs: opportunity cost (funds could be used elsewhere), valuation risk (currency fluctuations), and sometimes domestic inflationary effects (if sterilization is not managed properly).

Potential Impacts on the Indian Market

While a USD 396 million dip is relatively small in the context of ~$700+ billion, markets may still react. Here’s what might play out:

- Rupee volatility / currency risk

- If investors perceive that reserves are under pressure, they may anticipate more aggressive RBI intervention or expect rupee depreciation.

- A weaker rupee can make imports costlier (fuel, capital goods), which may feed inflation.

- Bond yields / interest rates

- External pressure on the currency could lead to capital outflows. To keep yields from spiking, RBI or government may need to tighten monetary policy or offer higher interest rates.

- If foreign investors see higher risk in Indian debt, they may demand higher returns, pushing up yields in government and corporate bonds.

- Equity markets (stocks)

- Exporters generally benefit from a weaker rupee (they earn more in rupee terms). So some sectors may see a tailwind.

- Companies with high import bills (especially in technology, energy, or capital goods) may face margin pressure.

- Overall investor sentiment: if the dip is interpreted as a sign of macro weakness or vulnerability to external shocks, it could trigger risk‐off flows.

- Credit / banking sector

- Higher interest rates, currency pressure, or tighter liquidity conditions could raise borrowing costs or hurt asset quality for banks/companies dependent on external funding.

- Monetary policy / RBI behavior

- The RBI might tighten oversight on outflows or intervene more in forex markets.

- The central bank may adopt a more cautious posture regarding liquidity injection policies or easing.

- Foreign investment flows

- Foreign Institutional Investors (FIIs) tend to be sensitive to currency and macro stability. Even modest dips can spark sentiment shifts.

- If global interest rates rise (e.g. in the US), Indian markets may see capital flight pressure, which can put additional burden on reserves.

In short: the dip is unlikely by itself to cause a market crash, but it can amplify downside risks, especially if combined with unfavorable global conditions (e.g. US rate hikes, global slowdown).

What to Watch Going Forward

- Weekly/monthly trends in forex reserves (especially FCAs)

- RBI commentary / intervention patterns

- Movements of the rupee vs USD and other major currencies

- Capital flows (foreign investments in equities & debt)

- Global cues: US rates, dollar strength, crises elsewhere

- Inflation and interest rate decisions from RBI

If reserve levels trend downward persistently or sharply, that would be more concerning than a one‐week dip.

By Nehal Taparia

This content is for educational and knowledge purposes only and should not be considered as investment or Trading advice. Please consult a certified financial advisor before making any investment or Trading decisions.

Our Recent FAQS

Frequently Asked Question &

Answers Here

Q1: Should I panic because the reserves dipped?

No — the dip is small in relative terms. Such weekly fluctuations in reserves are common and often driven by temporary factors. A long-term declining trend would warrant concern.

Q2: How often do reserves move?

Q3: Does lower reserves mean the rupee will crash?

Q4: Which sectors benefit or suffer from a weaker rupee?

Q5: Can India run out of reserves?

Q6: How does this affect foreign investors?

Q7: Will RBI intervene more because of this?

Copyright © By The Stock Learning. Design & Developed by Techno Duniya